How companies raise money

Estimated Reading Time: 2 minutes and 19 seconds

Last week I introduced Tuesday Terms, and we covered a few marketing buzzwords.

This week due to popular demand, we’ll go over terms that companies use when raising money.

But first, vote on next week’s Tuesday Terms topic!

Have other requests? Leave a comment below.

Funding Stages

When I first started working at a company that had raised money, the founder kept using the words “Series A, Series B, or seed round”. I just kind of nodded my head and pretended I knew what he was talking about because I had never learned what those meant.

These are all stages that companies go through to raise funding for their business.

Preseed

Seed

Series A

Series B

Series C

Series D

Generally, the earlier you invest, the riskier the investment is. Preseeds are often funded by the founders themselves. Seed rounds are smaller checks at smaller evaluations.

Often companies try to achieve profitability by their Series B or C rounds and further funding is not necessary.

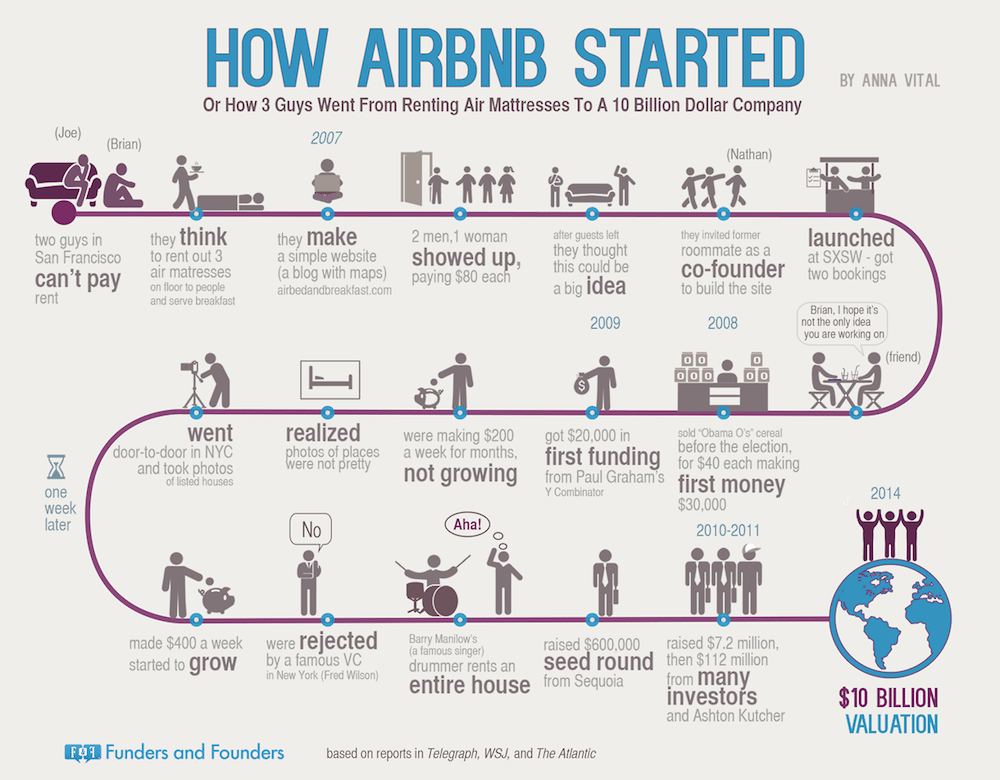

Here is a good graphic of Airbnb’s funding journey.

See if you can spot their preseed and seed rounds, then their Series A and Series B rounds.

Why would anyone invest in a company?

Only accredited investors can invest in private markets. They basically buy portions of the company based off the company’s valuation at the time of their investment.

For example, an angel investor invests in a company’s seed round.

The company is valued at $1,000,000, and the investor contributes $10,000. The angel investor now owns 1% of the company.

Deals are often much more complicated than this, but you get the idea.

Why would companies raise money?

Companies that are trying to achieve incredible growth will pursue funding. They use the money from investors to invest in growth personnel, open new markets, or build new products.

It all seems fine and dandy, but often these companies end up growing too quickly, and have to lay off their staff in order to actually become profitable.

When done right, injecting funding in a business can be a huge catalyst for growth.

When done wrong, taking outside money will make the founder lose control of the company and be at the mercy of the investors.

Should I raise money for my non-tech business?

The answer is probably not.

If you are starting from 0, no skills or abilities that are marketable, don’t go out and convince people to give you money.

You would be far better off building a simple service business from the ground up. For example:

Carpet Cleaning

Window Washing

Commercial Cleaning

If you have some skill or talent in an area that requires more money to pursue, then you could think about putting some money together from investors.

Heavy Machinery and excavating

Concrete pouring

Truck Driving

If you are on the fence about raising money or are not sure what would be best for your business, you can book a call with me to talk through your funding strategy, marketing plan, or even just talking about ideas.

Book a call with me here.(Use code STEELROAD for 50% off)

Take 2 seconds to click a link and give feedback on this post.

With your feedback, we can improve the newsletter. Click on a link to vote: