The fall of new construction creates the 2023 Gold Rush.

I’ve started to notice a new trend that only became more and more interesting the more I dove into it.

I have a pretty good pulse on the new home construction industry, and I’ve started to notice some contractor activity that could be worrying for some, and encouraging for others.

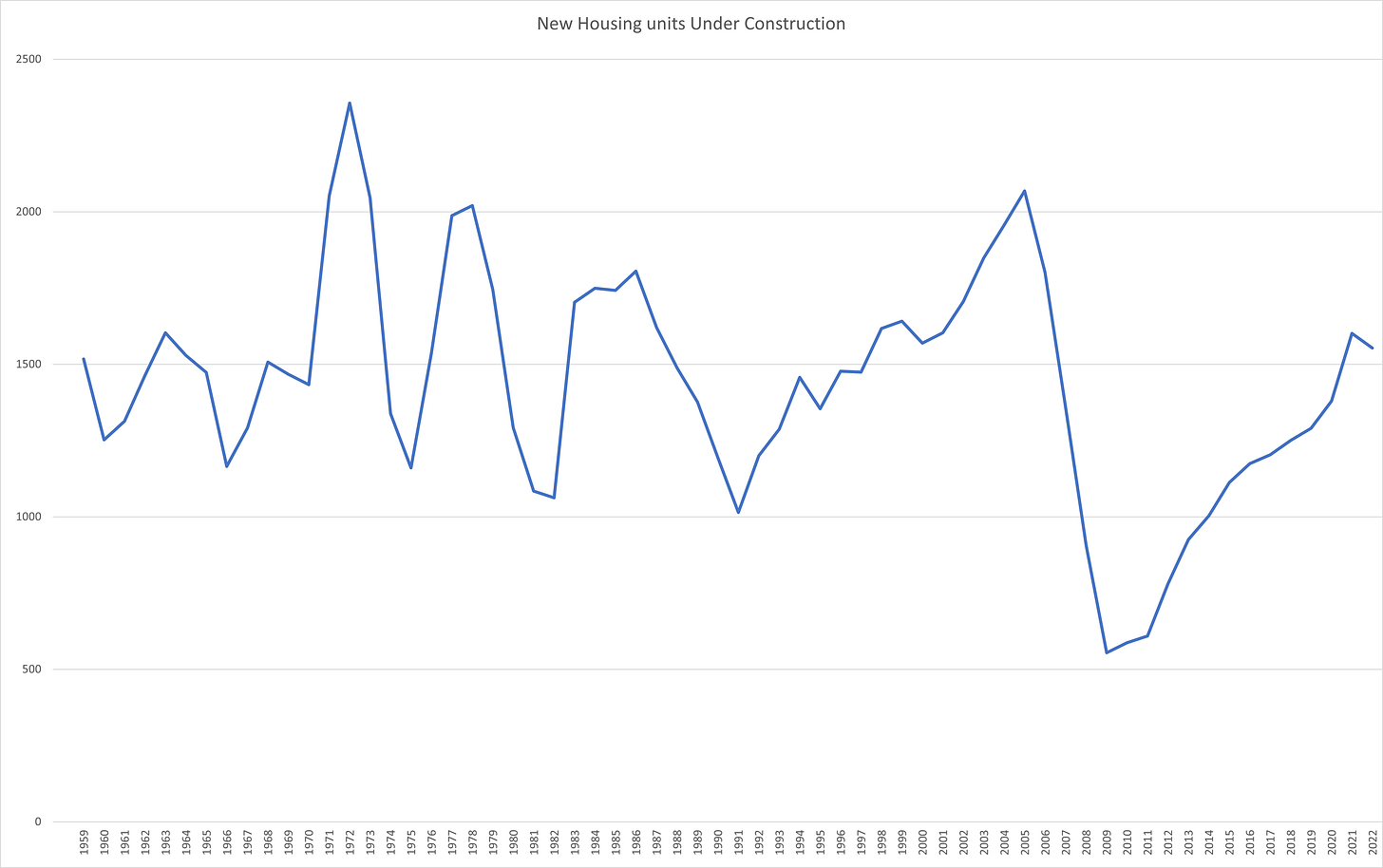

Total New Home Permits

*Housing units are shown at 1/1000. On the graph, 1000 represents 1,000,000.

I pulled this data directly from census.gov, put it into a spreadsheet and designed this graph. It’s interesting to see the rise and fall of new home construction over the last ten years.

Key Takeaways:

Historically, new home construction is either booming or reeling. There is very little flat, it’s either up or down.

When there is consistent growth for over 15 years(1991-2005), it has resulted in the biggest slide in recorded history(2008).

We’re coming off 13 years of up only, with the decline starting again in 2022. If this is the housing crash everyone is talking about and expecting, we can likely assume it’s going to be a big one.

If somehow we fix it like 1995, the resulting crash in 10 years is going to be way worse.

What does this mean for small businesses?

The million dollar question, what does this mean for me?

Right now, thousands of contractors across the country are looking around trying to decide how to play this.

Put yourself in the shoes of a HVAC subcontractor whose business is 80% New Construction and 20% Residential Service. Should you start to pare down New Construction and diversify into service work?

Think about how many industries this affects.

Roofing

Electrical

Plumbing

Landscaping

Paving and Concrete

Painting

Finish Carpentry

Flooring

HVAC

The businesses that don’t translate well to residential service are going to be hurting badly.

Fire engineering

Framing

Drywall

Stone and Masonry

Exterior finish

If you own one of these businesses and you rely heavily on new construction, it’s probably a stressful time right now.

What opportunities will this create?

Fortunately, there are a lot of great opportunities that will come out of a shift in contractor priorities.

New construction requires very little advertising. It is mainly based off relationships with key players and contractors.

Service work requires constant branding and upkeep of promotions and awareness. All these companies that will be looking to shift from new construction to service will need increased marketing and advertising budgets.

It’s a good time to be in the advertising industry. Higher competition for awareness and key words means higher marketing budgets and management fees.

As the state of the housing market reveals itself, we’re going to see an upswing in these categories.

Search Engine Marketing

Search Engine Optimization

Social Media advertising

Radio Advertising

Broadcast TV

YouTube Preroll

Billboards

Vehicle signage